Nirmala Menon is the Founder and CEO of Interweave Consulting (www.interweave.in). A consulting service focussed exclusively in the area of Diversity and Inclusion solutions for organisations.

“Something Else for J.K. Rowling to Feel Good About”

Quoting the HBR, “A study in two nations of students of various ages demonstrates that reading or listening to the Harry Potter novels and identifying with the main character increase tolerance of stigmatized groups, says a team led by Loris Vezzali of the University of Modena in Italy. For example, Italian elementary school children who listened to passages from the books over six weeks showed improved attitudes toward immigrants. In the books, which have sold more than 450 million copies worldwide, the hero is angered by discrimination, such as when Hermione Granger, who isn’t a pure-blood witch, is insulted as a “filthy little Mudblood.”

Possible lessons learnt:

- Critical role of appropriate role models during impressionable age

- Embedding story telling as a part of influencing diverse societies to be tolerant towards each other

- Influential leaders to consciously build on this mission

Terrorism into the mainstream of human consciousness

“Following the terror attacks in France, Western governments should avoid the temptation to see relations with MENA solely through the lens of counterterrorism, writes Jane Kinninmont. The attacks have prompted renewed denouncements of multiculturalism in some quarters, but the mood could ultimately support political parties that resist populism, writes Quentin Peel.” (Source: Chatham House).

Suddenly terrorism is neither just headline news nor flying into the face of common man but very much in the mainstream of human consciousness. Like a mutating virus defying mankind’s comprehension, its forms and spread seem at this moment to be challenging all of humanity. Just when it seems unstoppable, should insurers not re-visit their approach? Perhaps segment it to anticipate the evolving differentiation and rather just react also participate in prevention as well as mitigation. Revisit they must, as terrorism is a potential peril in any every form of cover across the non-life and life spectrums. In every which form it has a very high profile and strong socio-political ramifications both in the real and virtual space.

What next?

The first wake-up call by the ‘T’ factor in India goes back to the 1984 post Indira Gandhi assassination riots. Insurers expanded the Riot Strike Malicious Damage (RSMD) cover to an RSMTD. It took another 17 years for the next trigger in the form of 9/11 to create a Terrorism Pool in India. Just then the US created a TRIA (Terrorism Risk Insurance Act) as a means of a sovereign backing to its assets against terrorist acts. Terrorism cover predominantly remains coverage against lives and property. It needs to go beyond both in terms of scope, prevention and mitigation. Insurers ought to diversify their thought and action beyond the traditional realm.

Emerging segments

There is a growing demand world-wide for Cyber & Chemical/ Biological cover as a result of these types of terrorist attacks. There are a handful of select markets, particularly at the Lloyd’s, one of the pre-eminent hubs for specialist classes, who do offer this cover. However, coverages by most traditional carriers contain very robust & absolute exclusions regarding both Cyber, & Nuclear/ChemBio/ Radioactive coverages.

In relative terms to the wider market, say the experts in the field, this type of cover in the Terrorism sector specifically is still in its ‘infancy’ when it comes to fully understanding the exposures, implications & how to measure them in terms of safeguards, protections & aggregate management. The rest of the market continues to ponder and explore over recent years whether they ought to launch into this field, they do not seem to have got to the stage where they feel totally convinced about their readiness to justify such a big step that could have potentially ‘unquantifiable’ implications for them.

Insurers need to change the tack

Rather than just embark upon what is insurable and maintain a clear line of divide vis-à-vis all that is uninsurable, insurers need to accept terrorism as a fact of life. In the foreseeable future this will be one trigger that has the potential for generating significant ‘socio-economic’ losses. With the state slowly but steadily getting its upper hand over big events, terrorist acts will perhaps assume a low severity (in terms of asset class) but high implication (as in cyber or bio chem classes) and high frequency. Even in a traditional low severity scenario the non-financial implications could be high. Imagine the trauma caused to the sensitive segments of any society. Hence this allusion to ‘socio-economic’ rather than mere economic losses.

Some of the specialist markets do underwrite Terrorism Liability, but these usually contain the standard exclusion along the lines of “mental injury, anguish or shock where no bodily injury has occurred to the litigant”. It is interesting that not all specialist terrorism markets offer liability cover (it’s probably about 50/50, according to the experts). They believe that there is to date no sound case law for such cover (as it is a relatively new product in insurance terms which only really formally emerged quite a while after the 9/11 events). Interestingly, feel some observers that there is currently a case underway (not sure in which court jurisdiction) where a foreigner is apparently suing a prominent hotel as a result of him jumping out of a window during the 2008 Mumbai attacks, ‘but whether anything will ever come of this is hard to gauge’, says an expert. In his opinion “it can be extremely difficult to prove negligence or liability for ‘damage’ following such events, even if the defendant did not have effective security protections in place at the time.”

Insurers also need to participate in the distant early warning protocols which could alert not just them but society at large about future potential signals and triggers. Take for instance the excessive use of ground water to boost the cotton cultivation in Salamieh region of Syria. Followed by a drought and mass migration to urban areas, the unemployed economic refugees became a fodder for the socio-political uprising fuelling its own form of middle – east terrorism. A close cooperation between agriculture and micro insurers could have set the alarm ringing for the terrorism underwriters whether or not it was about to precipitate something insurable in the present.

In the realm of SciFi

Picking a few of Ray Kurzweil’s predictions:

- 2030s: Virtual reality will begin to feel 100% real. We will be able to upload our mind/consciousness by the end of the decade

- 2040s: Non-biological intelligence will be a billion times more capable than biological intelligence. Nanotech foglets will be able to make food out of thin air and create any object in the physical world at whim

- 2045s: We will multiply our intelligence a billion fold by linking wirelessly from our neocortex to a synthetic neocortex in the cloud

We are not talking about too distant a future nor does it call for high imagination to figure out how an evil intent could terrorise such extra-ordinary capabilities.

In conclusion

While most insurers would stick to this as a generally acceptable global definition for a terrorist act:

“….. acting alone or on behalf of or in connection with any organisation(s), committed for political, religious or ideological purposes including the intention to influence any government and/or to put the public in fear for such purposes”.

This in no way casts the current coverage and role of insurers in stone. In very many ways here could be an opportunity for insurers to play a more significant mainstream societal role in pre-empting and mitigating the scourge of terrorism. Whether or not they choose to underwrite it they could still warm up as risk managers, while it holds its sway now and in the predictable future.

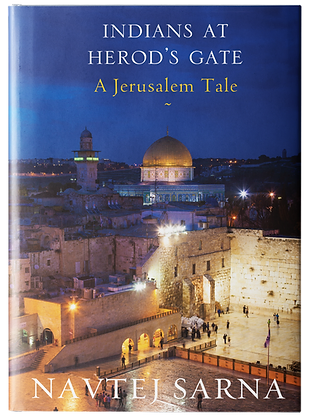

“History sometimes leaves no traces” and certainly in what seems on the face of it a very mundane theme, the author’s engaging research finds the links and trails that lead us to a fabulous story.

“That I gathered enough courage to make this attempt to unpeel the centuries…” perhaps is the essence of not just what the author Navtej did in putting together his latest work “Indians At Herod’s Gate: A Jerusalem Tale”, but also what it did to him and the reader as well.

“History sometimes leaves no traces” and certainly in what seems on the face of it a very mundane theme, the author’s engaging research finds the links and trails that lead us to a fabulous story. Soon after landing in Tel Aviv as the country’s ambassador he hears about Baba Farid’s Hospice in Jerusalem. A seed for the next book is safely lodged in the fertile and curious recesses of a creative mind.

It is the integrity, character and the conviction that reveals the several personae of the author, a man on an otherwise ambassadorial role knocking on the doors of ‘Zawiya al-Hindiya’ or the Indian Hospice, an Indian presence in the middle of old Jerusalem.

I was privileged to have gone sightseeing around the Holy City with Navtej while this book was in the making. As I read the book, each word takes me back to him narrating the story. It often meanders into the direction of our discussions. For instance, could Guru Nanak in his time, like Sufi Saint Baba Farid on his way back and forth Mecca, too have stopped by at the Indian Hospice?

It is not just an account of a care-taking family’s heroic deeds, in whose courtyard flies an Indian flag, amidst one of the most troubled spots in the world. Nor is it just an account of some 800 plus years of history around the lanes and by-lanes of the Zawiya but an inquisitive mind risking itself, seeking the threads to weave an extraordinary account, in a volatile backdrop.

Amongst many an unpeeling that go on in my head – as I read the account – are things from my long past, my visit to Israel and everything else. There is ‘Oh Jerusalem’; ‘Exodus’; Ben Hur; Ten Commandments; Bethlehem and the tour guide Isa who wonders why must I wish to visit the Church of Nativity if I am not baptized; Judean Desert; Masada; Dead Sea; Sea of Galilee; food, olives and wine at the Kibbutz; Marathi speaking Jewish driver-cum-guide; Retired tank commander’s (now a high profile travel coordinator; gave me an option of 14 languages to facilitate my tour!) woes with Indian tourists; Curious youngsters who had or wished to visit India; Stunning Mediterranean expanse off Herzelia; Haifa’s classy art decos; Zubin Mehta and his afternoon concert; Rampart Walk; Indian Hospice; and American Colony Hotel.

You could take a boat from Karachi to Basra and drive via Baghdad to Jerusalem. When Jerusalem was a magnet for the mystics and a must on the Mystic Route, wherever it started or ended!

Waves after waves of mixed feelings of times when there were fewer political boundaries, travel was far less complicated and despite its cycles of civilisational ups and downs it was not really a perennial hotspot of disruption. You could take a boat from Karachi to Basra and drive via Baghdad to Jerusalem. When Jerusalem was a magnet for the mystics and a must on the Mystic Route, wherever it started or ended!

The author paints his canvas on a man from Saharanpur, who due to a dramatic turn of events, lands in the Holy city of three major religions. All to become the Sheikh of a slice of India that has drifted miles away from the conscience of the subcontinent. A refuge for Indian pilgrims right from the medieval times and its soldiers during the great wars. What a lovely depiction.

While Navtej in his modesty gives credit to the friendship, cooperation and knowledge of many people for making the book possible, he is silent and self-effacing in what else went into this creation. To the discerning eye the layers underneath the diplomat – be these the writer, journalist, historian, archaeologist, researcher and a statesman – would be hard to miss!

Hannah Devlin, Science Editor at The Times, recently reported that robots could be granted legal “personhood” under recommendations made to the European parliament on how intelligent robotic systems should be governed in the future.

Is there a broad spectrum of differentiation emerging ranging from personhood to humanhood with robots, chimpanzees and cetaceans adding to the growing list? How may it impact first mover, the Homo sapiens is anybody’s guess?

It may be desirable for robotic companions to carry out financial transactions independently, which would require them to have a legal status similar to that of a corporation. Robots could also be held liable for damage to property or injuries they cause, to shield the owner from financial responsibility, the review document suggests.

“At the moment robots can only act as ‘mere tools’, meaning the legal responsibility for the robot’s actions rests with its human ‘master’. This might restrict robotic companions for the elderly and make it hard for them to buy groceries, collect medication or carry out bank transactions on their owner’s behalf.”

Dr Andrea Bertolini, of Scuola Superiore Sant’Anna in Pisa, who helped draft the recommendations according to The Times, said they reflected the changing roles of robots in society. “In Pisa, they are developing a robot that is capable of travelling from your home to the grocery store and paying for goods that it needs. In cases like this you may want to consider the robot as a legal person that is able to enter into a contract”, he said.

“The recommended changes in status were purely technical rather than an endorsement of robot rights or a suggestion that robots would be genuinely autonomous.” He added, “There are futurists who talk about the rights to marry robots – that’s not what we’re getting into”.

The European Commission asked the RoboLaw consortium to look at how robotic and human enhancement technologies could be safely and successfully introduced into society. Presenting their findings to the European parliament recently, the authors said that the lack of appropriate regulations might be stifling progress in robotics already, according to Devlin.

“The question of who pays for damages is the largest obstacle to driverless vehicles in our society”, according to Dr Bertolini. “Driverless cars could reduce accidents by 97 per cent”, he believes, “but under present legislation the manufacturer could be liable for accidents”.

Devlin also quotes Julia Reda, a German MEP who believes robot governance is still seen as “fringe interest” despite their having a big impact. “It’s important that robolaw becomes a political discussion at an early stage,” she said. “Some things that might seem extremely weird to us now could become beneficial in the near future.”

While humans navigate through this evolving humanhood / personhood dilemma (hopefully welcoming the emerging diversity) and robolawyers pen their script, insurers and HR professionals must get their act right in dealing with what’s set to become an increasingly vigorous knock on their doors.

Published in the Journal of Insurance Institute of India, July-September 2014

It is September of 2007, I am sitting in an auditorium filled up with 150 young school students generally under the age of 15 years. The event is 58th Conference of International Astronautical Congress at Hyderabad, under the theme of “Touching Humanity: Space for improving quality of life”.

The then President of India, Dr. Abdul Kalam is the chief guest, walks in just in time for his Q&A with these students. There is a tremendous sense of anticipation.

In no time he is on the stage with the Chairman of ISRO Dr Madhavan Nair. He needs no introduction. He has always been known as India’s rocket man!

“I have two questions” he says, “before you start asking me your questions”!

“How many of you want to go to the moon?” In a flash, 300 hands go up. He smiles.

“And how many of you wish to go to the Mars?” Yet again, the same 300 hands are up!

He cannot help smiling again and looks at the ISRO Chairman. “Madhavan”, he says, “you better do something about this aspiration. They are anyway going to get there”. Kalpana Chawla, Sunita Williams and Rakesh Sharma would be just pioneering greats on a long list in making.

Then very quickly a young girl training as an astronaut is introduced to the audience. Wow, what a feeling that was.

Pierre Lys, my fellow delegate, who was a space insurer then and I catch up at a tea break. He was attending a parallel session on space debris and wonders what is it that I was doing at the kids’ session.

“Well Pierre”, I tell him, “I just got a glimpse into India’s future. Nothing could be more telling”.

I can only say that the Mars mission is the beginning of a very long march. It represents first of many baby steps. Please be on the lookout for what comes next!

I had the pleasure of presenting a paper titled “Adapting long-tail pricing models: Scope for shared learning – India & China” recently at the 2014 China International Conference on Insurance and Risk Management (CICIRM), in Shenzhen, Guangdong province, adjoining the Hong Kong SAR. A city that late patriarch Chairman Deng Xiao Ping wanted to mirror Hong Kong. Mirrored it has in terms of high rises, elegant highways, golf courses and what have you.

The conference venue Ping An School of Financial Service itself located on the edge of a golf course, is in close proximity to Mission Hills the world’s largest golf club with a dozen courses. The School is one of the 50 small and large campuses across China, owned by Ping An Insurance Company. The insurer is currently building what is supposedly world’s second tallest structure, the Ping An Tower.

Metaphorically Shenzhen’s aerial graph is representative of Chinese insurance business. From late eighties or even early nineties when the Chinese life market was virtually non-existent and non-life had just begun to warm up, it is today a USD 100 billion market with Auto class exceeding 70%. Some analysts believe it will double by 2020. Nowhere in the history of civilised world has the non-life segment grown at such pace. This makes China almost ten times larger than India. Their non-life portfolio mind you does not include the Health segment.

Unique challenges:

Despite significant differences, China and India have many underlying similarities. The character and circumstances particularly in the long-tail class create opportunities for collaboration. There are also interesting possibilities in the voluminous process driven short-tailed classes.

Long-tail liability class poses unique challenges in any jurisdiction where new products are adapted for the first time. Generally most non-life insurance contracts are for one year. But not all are alike. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many years fall in the long-tail class. Claims can be presented to the insurance company a long time after the occurrence of the trigger event.

The key issue to such a class relates to an appropriate pricing. With no past experience on frequency and severity of claims, in this class, the pricing models have to be adapted from overseas environment from where these products are transplanted. As tort raises its head in adapted markets, pricing adequacy will be tested in such places. In the meantime, what do markets do to ensure there are no rude shocks-in-making. Particularly when pricing pressures in the short-tail classes tend to have a rub-on effect on the longer-tailed. In wake of the de-tariffication we are witnessing some serious pricing reductions in the short tail classes year on year, which are not sustainable and harmful for all stakeholders in the long run.

The big question, therefore, is whether the long-tail class pricing is aligned to the market conditions? The obvious answer is no. So what may happen if this is not the case. Well, there could be several scenarios:

- Pricing assumptions may relate to overseas markets (say product liability or errors & omission) and the book for such markets grows.

- Book for domestic markets may grow and so could the risk factors and thereby the multipliers applicable in home markets of these rating assumptions may outlive their utility. About three decades ago, for example, Hong Kong was in the midst of one such debate. The erstwhile British colony virtually rebelled to the proposition of applying the UK multipliers when considering settlement of bodily injury claims. The logic was simple. Hong Kong’s per capita income, inflation and longevity of its people was way above those in the UK. This eventually led to the case for capping the unlimited bodily injury cover as the claims started spiralling.

The introduction of tort law in China since 2010 and the implications of the Indian Companies Act 2013 transform the two playfields across all liability classes be it Motor Third Party; Medical Malpractice, Directors and Officers and the whole range of Professional Indemnity space.

In the long run it is the domestic transformations that need to be watched more closely. An analogy may be drawn with manufacturing cycles of the Far East markets which started as export hubs but steadily became markets for their own wares. China will be no exception as the internal consumption rises. Likewise, the back office capital of the world – India, is beginning to plug into the needs of its domestic market. Such changes will create far larger risk environments at home. The triggers will generally sit inside and not outside these economies and societies. Some of them may very well be in place and shall manifest in a matter of time. In the meantime have the covers been adequately priced to pay for the future claims, is the key concern.

It is indeed very impressive to see the number of non-life actuaries qualifying and also the number of young Chinese pursuing doctoral programmes in insurance. We have surely a lot to learn and imbibe if we need to bring in some brain power in the evolving complexities and scale of this new class of risk in our economy and society. A collaborative effort can only strengthen the outcome for both countries.

Till about the late eighties and early nineties the Indian insurance market was largely a corporate commercial book. The retail class began to take off on the back of increased demand well after the arrival of health insurance (primarily in the form of ‘Mediclaim’) and only when the auto boom picked up. The relative size of the latter also received a boost after the meltdown of the tariff classes. China on the contrary took off thanks to its own auto zoom. It produces in one month what we do in twelve. It may very well happen that in this huge build-up of the retail segments, the complexities of long tail related to the corporate and commercial classes may not receive adequate attention by either of us. Particularly when both the markets are predominantly obsessed with profits post investment returns rather than an underwriting profit.

Conclusion:

Perhaps the biggest dissimilarity between our two markets arises from the transaction language. The Chinese virtually use no English. This could provide some interesting opportunities. Our obsession with English is almost like turning a blind eye to non-English possibilities. Imagine what size could open up if we were to unlock the potential backup to the Chinese BFSI opportunity. Firstly, in Chinese (primarily Mandarin) and maybe in the long-run by supporting their aspiration to switch to English. There is a plenty of room to collaborate not so much in the form of Chinese insurers investing in our insurance business but primarily in knowledge sharing; managing big data and analytics. High time we look at the big neighbour face to face rather than the current back to back stance and proactively deal with a liability situation that could collectively become larger than the existing in the US. It is after all about a win-win for two of the world’s three largest economies.

Twenty one years ago when I first went to work and live in Hong Kong, a drive to the border post of Luk Ma Chow was a major attraction. From here one could peep, across the border, into a not so distant Shenzhen in the Guangdong province. All that you saw in the close proximity was duck farms. On a clear day, without having to rub your eyes, you could also spot an emerging concrete jungle of tall buildings with cranes atop. And you could not miss out a high density of container traffic flow through the border check point.

I had spent a couple of years in Thailand before this assignment. In the course of which I made a very fascinating discovery. Thanks to a trader client well connected to the land of his origin and a new found ‘guanxi’ (network). He would buy used earth moving equipment from the world over, recondition them and export these to China. What is it that spurred such a demand?

Like never before, China was moving the earth. For the first time in the history of mankind any part of the world witnessed such frenetic pace of growth. The GDPs of coastal areas including Guangdong grew 30 to 40% pa. The stories about truck drivers with wives on both sides of the border or guys getting overwhelmed by things like showers in hotel rooms in Guangzhou – are a couple of a multitude of frivolous stories I can recount – from those times. But on a serious note, a few weeks ago, I crossed the border into Shenzhen, on an invitation to present a paper at an academic conference. It is then that I witnessed the full thrust of what the late Patriarch Deng Xiao Ping meant by “One Country, Two Systems”.

The Shenzhen magic races far beyond the Special Economic Zone, which the pragmatic leader saw as a counter to the then English colony of HK. The times when the English Governor Chris Patten of the queen’s territory daily sparred with a super power in making. The ferocious velocity of which was perhaps far beyond the scales of their speedometer. An hour plus long drive brought me to the Ping An Institute of Finance. The big gates open into a very modern and immaculately landscaped full sized golf course and an impressive array of buildings. The foyer of the main building has a statue of Confucius and Einstein greeting you.

The famous Mission Hills Golf Club, world’s largest golfing ground with a dozen courses, is close by. I am told Ping An, a leading insurance company, has 50 campuses big and small across China. A market which is already a USD 100 billion worth of non-life business and slated to more than double in the next ten years needs a very large army of knowledge workers and this is indeed one definite way of building it. This is where the amazing growth story rolls on notwithstanding the English language.

At the grand dinner by the host company in the Mission Hills Golf Club, I have young David from the Tsinghua School of Management from Beijing sitting on my left. He has lots of questions and observations from this only Indian at the event. It does not take much effort to convince him to call me by my first name. India is a land of mystery to me, he says. He is curious about the serious divide between the rich and poor. We continue our dialogue between speeches and the toasts.

The return ride back to the Shenzhen border next day was fascinating. I tried hard to figure out which was the tallest building around and where was the Ping An tower sprouting, world’s second tallest building – to – be after the Burj Khalifa, Dubai. My driver today, as well, merrily laughs to my queries in English. He is blissful and it does not really matter to him whether or not he is proficient in English. Life transformed for good, despite it. He is speeding as if these freeways have been there forever and the big cars is what he grew up in. Then suddenly there is a roaring sound from behind. A red Ferrari, wanting to overtake all that is ahead. In no time it navigates through and well before I can focus my phone for a quick shot, it’s gone. I have even stopped hearing the prancing stallion.

Once back home, I get a polite mail from my new found friend David Zheng enclosing some pictures from the event. I promptly thank him. And then comes the return mail which looks and sounds innocuous. “Dear Praveen, he says, It’s glad to receive your message! And this is my first time to receive message from outside of China…” It’s like I wrote a postcard to him some five thousand years ago when our’s were the two dominant civilisations.

We actively traded on the silk route. There was an amazing flow of wares and ideas. We had the well known Hiuen Tsang (Xuanzang), the ‘Prince of Pilgrims’, and Fa-Hien (Faxian) visiting our centres of learning. We exported Buddhism to them. We also exported the concept of Dhyan (Sanskrit for a state of no-mind), which moved to the Buddhist language Pali incarnating as Zhan. Becoming Chan by the time it reached China and eventually Zen in Japan!

Today after several millennia David Zheng found a medium to communicate and complete the loop. He has bridged the march of our civilisations. I am sure the mysteries will shed. Like my revelations beyond the duck farms at Luk Ma Chow…