“This apparent gap between purpose and pay is in our view limiting or slowing down the transition to a sustainable economy”.

Praveen Gupta: Insurers tend to be lagging behind on the climate agenda. A recent ShareAction finding shows, the investment side seems to be performing better than the underwriting. Is this something to do with remuneration practices?

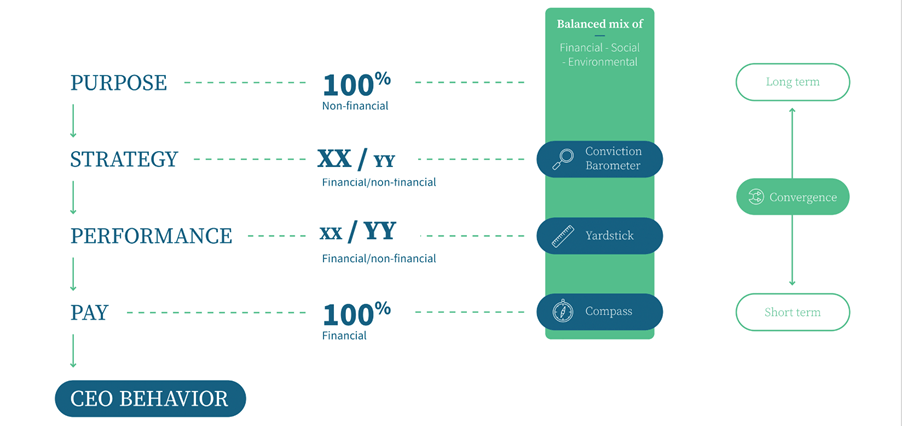

Frederic Barge: Although executive remuneration is not the sole driver for change, it does play a relevant role. Many corporations have established their purpose over the last decade. In line with the societal concerns, corporations have phrased their “reason d’etre” and their role in society. Their purpose statement is clearly focused on the non-financial contribution to society on the long-term. Looking at executive remuneration most of the purpose elements have disappeared. The vast majority of executive remuneration at corporations is linked to short-term financial performance, and this is often not contributing to the long-term value creation for the corporation’s stakeholders (including shareholders). This apparent gap between purpose and pay is in our view limiting or slowing down the transition to a sustainable economy.

We at Reward Value Foundation, strongly believe that the gap between purpose and pay needs to be closed. This requires changing the time horizon of pay, as well as redefining corporate success. The latter means that corporate success is defined by measuring the impact of the corporation on society from a financial, environmental, and social perspective. Extending the incentive structure, even beyond the active period of the executive, will positively affect the time orientation of the executive and potentially support the focus on innovative and R&D driven investments. Such investments are dearly needed to support the transition to a sustainable and inclusive economy.

Insurers as investment managers are more focused on incorporating ESG factors in their investment philosophy. Also, external regulation is demanding a firm commitment from investors to drive sustainable finance. The developments in the EU with the Green New Deal are a clear example of regulatory pressure on investors. In the underwriting business this awareness is currently less visible, although the impact of climate change will have significant effects on the insurance business. Looking at executive pay policies at many insurance companies; remuneration of executives is still fully or almost fully linked to financial performance criteria. A change in remuneration design may be supportive in changing behaviour of executives and their organisations.

PG: There is a serious shortage of climate literate board members. How do you resolve that?

FB: Russell Reynolds and the UN Global Compact have made an analysis of the inclusion of ESG knowledge in board and executive vacancies. It turned out that only 4% of the vacancies had some ESG requirements in the hiring process. So, looking at that study, it becomes apparent that already in the hiring process, ESG-related knowledge, and experience (including climate) should be a key component of sought expertise. Diversity of experience (as well as diversity broadly) will add to the effectiveness of boards. Secondly, ESG knowledge can and should be shared in education programmes both for existing leaders as well as for future leaders. As Reward Value we will contribute to such curriculum additions with our research on executive remuneration and our behavioural experimental research. By including ESG into executive remuneration, and more importantly in strategy, strengthening the internal expertise and obtain access to external advice will become of paramount importance.

PG: Do you see corporations talk long-term and act short-term? How do you fix this misalignment to ensure a sustainable outcome?

FB: As I mentioned, corporate purpose statements are mainly long-term oriented, while executive pay is much more short-term oriented. This misalignment needs to be addressed for several reasons. First of all, intrinsically well-motivated leaders should not be hindered by incentives that take their attention away from long-term sustainable value creation. It is key that extrinsic motivation through incentives is enforcing leaders to execute in accordance with their intrinsic motivation to do good. Secondly, incentive agreements are a contract between managers and their company, whereby shareholders are to vote on the remuneration policy. This means that a remuneration plan mainly focused on short-term financial performance also tells you something about the shareholder view on long-term sustainable value creation.

Shareholders should support alignment of pay to purpose and therewith demonstrate their own commitment to a sustainable, regenerative, and inclusive economy. Thirdly, extending incentives and maybe even extending nomination periods, may also support the willingness of leaders to invest in R&D and innovation. Dealing with today’s challenges to the environment and society requires corporations to move away from short-term earnings realization towards long-term sustainable value creation. In summary, time orientation needs change among the different market parties.

PG: Some sustainability practitioners in Europe suspect significant greenwash under the guise of green new deal. Shareholder versus stakeholder remains an unfinished agenda?

FB: I believe that with respect to environmental and especially climate related topics, we are not completely there yet. But corporations are more and more aware that change will happen. I am positive that corporations learn to think not only in risks but also in opportunities with respect to climate change. Regulation remains important, especially from a reporting and disclosure perspective, but making sure that regulation is stimulating behavioural change rather than stimulating a compliance “tick-the-box” mentality or even worse an evasion mentality. To be effective, corporate behaviour towards sustainability must be based on corporate intrinsic motivation and conviction, and not on compliant reactive response to regulatory requirements. With respect societal topics and especially diversity and inequality, the progress is much slower and also gets much less attention. Yet both climate and inequality are disruptive to society and deserve immediate action.

Your second question on shareholder versus stakeholder is more difficult to predict. The future of the current business model of corporations with (concentrated) shareholders is dependent on the success of the business and investment community to deal with the stakeholder well-being including that of the shareholders. The increased interest in different structures like B-corps and co-operative structures with shared ownership among a multitude of stakeholders is a promising development but needs a significant overhaul of legislation in jurisdictions across the globe and therefore will most probably progress more slowly. Ignoring inequality will accelerate the desire for new corporate structures. This in itself is another reason for shareholders to take societal issues very seriously and stimulate businesses to better serve its stakeholders.

PG: In absence of desired behavioural change do you prescribe an element of claw-back?

FB: Payment schemes that reward executives for realised investment returns but do not penalise negative returns, encourage excessive risk-taking. Two commonly used measures to combat the potential forms of fraud and exercise risk-taking are: Bonus caps and claw-back measures. Bonus caps create a ceiling for the variable compensation, and claw-back measures make it possible to reclaim bonusses that were awarded in the past. A disadvantage to the bonus cap is that it can potentially cause a drop in effort after the maximum bonus is reached. This is less the case for the claw-back measures. The effectiveness of claw back measures, however, is still limited. On the one hand, it requires a strong board of directors that is willing to act when needed and expected. Often such difficult decisions remain not taken. Secondly, from a legal perspective it is often difficult to execute on claw-back policies. Legislative amendments are needed to make claw-back an effective tool and therewith become effective in influencing executive behaviour.

PG: How can companies strive to become sustainable contributors to societal long-term value creation, when their chief executives are remunerated on short-term goals?

FB: Whereas purpose has evolved taking the challenges of today and tomorrow into account, pay has remained unchanged except for the level of pay. This gap has to be addressed. What analysis is needed?

In the assumption that pay reflects a performance[1], the first question to ask is what performance should be remunerated? This requires a renewed definition of corporate success, which should entail the impact of the company on society both from a financial perspective and from a non-financial perspective (environment and social). The success of an organisation should be measured according to financial, environmental, and social impact. Ideally, the environmental and social impact is monetized to allow an overall assessment in the same currency with the financial impact. The approach of the Impact Weighted Accounts Initiative of the Harvard University is a strong tool for this.

Next to a quantitative analysis based on impact measurement, a qualitative assessment of corporate activities is needed, whereby the materiality of the sustainability strategies of companies is key, as research has also demonstrated that only the material sustainability topics add value on the long-term[2]. Many corporate governance codes require companies to contribute to long-term value creation. Often the definition of long-term is not given. Especially, when pay is structured in shares (as also recommended by Prof. Alex Edmans), it is important to understand when share valuation is a fair reflection of a company’s accounting valuation (both financial and non-financial). As you can see in the picture here above, Reward Value performs research on these three elements of long-term value creation, being quantitative impact analysis (Impact Yardstick), qualitative strategic analysis (conviction barometer) and definition of long-term (convergence).

The subsequent next important analysis to make is whether renewed remuneration design will impact executive and corporate behaviour. According to research, executives at least seem to demonstrate short-term oriented behaviour around vesting moments of incentives.[3] By means of experimental research, Reward Value is exactly examining this question. Our research is on-going, and it is too early to tell whether it will be effective, but the analysis needs to be made before any conclusions, as made in your article by some, can be made.

Finally, renewed executive remuneration also needs renewed corporate governance and strict and mandatory reporting. Moving executive remuneration away from short-term financial coupled with vague non-financial targets to long-term sustainable value creation with transparent mandatory reporting will in our view result in a better alignment of pay with purpose. The experimental research will be able to give more insights in the effectiveness of executive pay in changing corporate behaviour. Executive pay will never be the solution to all but structured well it could be a catalyst for change. From Reward Value Foundation, we invite academics and market parties to participate in and contribute to our research.

PG: There is a significant gap between what women and men get paid across the rank and file?

FB: Whereas most attention is nowadays given to climate, the other big disrupter in today’s world is inequality. An inclusive society gives equal opportunities to all and does not discriminate on the basis of gender or ethnic diversities. An inclusive society unites people and establishes a social cohesion. In a report published in 2019, ILO demonstrates that diversity leads to better corporate performance.[4] In an extensive literature review performed by Anja Kirsch, the positive effect of gender diverse boards on social and ethical aspects of firm behavior is discussed.[5] Also the Sustainable Development Goals of the UN Global Compact[6] give clear guidelines on diversity and inclusion. I mention just two sub goals:

- SDG 5.5

Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision making in political, economic and public life. - SDG 10.3

Ensure equal opportunity and reduce inequalities of outcome, including by eliminating discriminatory laws, policies and practices, and promoting appropriate legislation, policies and action in this regard.

PG: My best wishes, Frederic, in your endeavour to bridge executive remuneration with the long-term value creation. The sooner we get there the faster would we transition to a sustainable economy.

[1] Gabaix, Landier, and Sauvagnat (2013), CEO Pay and Firm Size: An update after the crisis. Frydman & Saks (2008), Executive Compensation: A new view from a long-term perspective, 1936 – 2005.

[2] Serafeim, Kahn, and Yoon (2016), Corporate Sustainability: First Evidence on Materiality.

[3] Edmans, Fang, and Lewellen (2017), Equity Vesting and Investment.

[4] ILO (2019), Women in Business and Management: The business case for change.

[5] Kirsch, A. (2018), The gender composition of corporate boards: A review and research agenda.

This interview takes the executive compensation issue head on, which is essentially the elephant in the room. It also highlights the reluctance of corporate boards to go beyond optics of environmental issues because,in the short run, every environemtnally responsible action carries costs for the business while the returns are visible only in the long run. Unless the environmental activists take up this issue as a key driver of corporate behaviour, everything else will lose its effectiveness.

Congratulations Praveen for the probing questions and thank you Frederic for your thoughtful responses.