Matthew Hill is the Chief Executive Officer of the Chartered Insurance Institute since April 2024. He comes with a rich and very diverse career path. Matthew studied Biochemistry at Lady Margaret Hall, Oxford.

Praveen Gupta: Increasingly, more and more European insurers and reinsurers are moving away from insuring and investing in fossil fuels. Would you expect this to be replicated globally?

Matthew Hill: The evolution of markets over the past few years has not been smooth, reflecting differences in political and public sentiment towards fossil fuel extraction around the world. For example, we saw a lot of firms in Europe withdraw from these markets between 2018 and 2023, but that wasn’t mirrored in North America, Latin America or Asia at the time.1 My reading of commentators’ views is that little has changed in the past couple of years that would suggest a further decline in participation in the short term, though there is also more talk about the adoption of novel solutions, such as self-insurance or expanding captive markets.

“I believe the sector is doing what it has always done well – reacting and evolving to the changing environment.

However, I think it’s equally important to look at the way in which our profession is supporting the development of new, greener technologies. We are seeing substantial growth in solar, wind and tidal energy along with storage capabilities. Insurance companies recognise that this is the long-term future of our energy needs and are facilitating investment in them around the world.

Novel technologies are not without risk themselves, but I believe the sector is doing what it has always done well – reacting and evolving to the changing environment. We’re proud to be playing our part in facilitating that change through educational initiatives, such as our Certificate in Climate Change, and by bringing experts together to discuss challenges and find potential solutions, as we did at the end of 2023 when we held a conference dedicated to sustainability.

PG: Climate risk has a much broader scope entailing biodiversity loss and pollution. Are we ready to address the growing challenge with due urgency?

MH: The biggest challenge with climate change is uncertainty. Knowing the direct and indirect implications of individual actions for distinct environments can be hard. However, if any profession were well adapted to handling that challenge, it’s the insurance profession. Climate risk is necessitating the rethinking of traditional approaches to risk management, pricing and claims modeling, while the inevitable opening of some protection gaps is actually providing the incentive for existing firms and new entrants to develop novel solutions.

“The biggest challenge with climate change is uncertainty… However, if any profession were well adapted to handling that challenge, it’s the insurance profession.

We’ve seen some good examples of this in recent times, particularly with the development of parametric products that pay out automatically under certain circumstances. As such, I have no doubt that the insurance profession can find ways to support societies where it is desired. For me, the challenge is more around widening the conversation with policymakers and other stakeholders, so we all best understand the challenge we face and work together to find the right responses.

PG: Are we ready for yet another pandemic?

MH: I think the insurance profession proved during the COVID pandemic that it exists to serve society and is a critical enabler of resilience and recovery. It’s often said that the next crisis will be nothing like the previous one, so it’s hard to say whether anybody is truly ready, but it’s apparent that our profession has responded to the challenges encountered by individuals and firms at the start of this decade through the development of new forms of cover, such as the development, transit and storage of vaccines.

PG: With the arrival of #Polycrisis, don’t you think a new risk architecture is called for?

MH: I’m not sure the paradigm in which we now find ourselves has crept up on the insurance profession. We are a sector that is home to global firms, as well as niche specialists, who are all interconnected by brokers, underwriters and reinsurers that openly talk about the challenges and opportunities they face on a daily basis. Organisations like the CII help to further shine a light on the work of the sector by bringing participants together and distilling conversations and findings for other audiences, such as policymakers and the public. The openness with which we share information encourages debate and new participants to enter our market, who can bring fresh ideas, technology and ways of working. By implication, our risk architecture has been continuously evolving since insurance came into existence, and I think it will continue to do so in myriad different ways into the future, reflecting societal need.

“Organisations like the CII help to further shine a light on the work of the sector by bringing participants together and distilling conversations and findings for other audiences…

PG: Is Climate Change getting the due attention it deserves by insurance and risk management curriculum?

MH: There is no doubt in my mind that the insurance profession understands the severity of climate change. Annual natural catastrophe losses of at least $100 billion have become a fact of life, with no country seemingly immune to the impact of climate events. More than 40% of the world’s population now reside in climate-vulnerable locations and around 20% of global corporates are facing financial rating downgrades by 2035 due to climate vulnerabilities. The CII has held dedicated conferences on the subject, as well as developing new qualifications, CPD and practical guidance to help professionals understand and navigate the issues.

That’s not to say there is not more that can be done. The size of the challenge undoubtedly means that a societal response is needed, involving policy makers, regulators, technology developers and other stakeholders. For our part, in 2021 we introduced a dedicated Certificate in Climate Change. Since then we have had nearly 300 learners take the certificate, with broadly similar numbers (c70) in each of the past three years. The syllabus was reviewed and updated in 2023, and we will complete a further update in early 2026.

PG: Many thanks Matthew for these excellent insights. My best wishes for your leadership in these challenging times.

The Journal, Chartered Insurance Institute (APAC)

June – July, 2025

https://thejournal.cii.co.uk/features/2025/07/09/waiting-oliver

FUTURE SHOCK by Alvin Toffler & his wife Adelaide Farrell has stayed as a playbook for me in terms of insurance industry’s tech trajectory. While the authors did not call it AI, they envisioned how far tech would aid human advancement. Needless to mention all the cautionary advice packaged in – to ensure we do not abdicate to it. “Our choice of technologies, in short, will decisively shape the cultural styles of the future,” Toffler once cautioned.

The industry audience I had the pleasure of interacting with recently – courtesy CII HK – gave me the confidence that they know when to say STOP!

And how can I not acknowledge the power of a gift. This book came to me from a dear friend just as I started my hesitant career in insurance. It has disappeared and reappeared as I have moved homes and locations. Its pages yellower each time I look it up. However, the intensity of how it continues to fuel my imagination is a constant.

Blair Palese is Director of Philanthropy at Ethinvest and founder of the Climate Capital Forum, a network of investors, decarbonising businesses, climate finance experts and philanthropists advocating for Australia to lead in the global net zero economy. She is also co-founder/contributor at Climate & Capital Media, a global online outlet covering emerging climate opportunities.

Blair founded and was CEO of 350.org Australia for ten years from 2009 and has worked for companies, government programs and not-for profits in the climate and environment space, including the Google X Moonshot team, C40 cities for climate action, The Body Shop with founder Anita Roddick and as communication director for Greenpeace International and Greenpeace USA.

Praveen Gupta: Australia is one of the world’s most vulnerable countries to climate change impacts, facing ever-worsening droughts, bushfires, flooding, and rising sea levels.

Blair Palese: More than most nations in the world, experts say Australia is highly vulnerable to climate change impacts – drought, flooding, extreme weather and fire. This means we need to reduce our emissions and move rapidly away from polluting fossil fuels to clean alternatives not only for our climate, economy and energy security but to try to mitigate the incredible costs of these growing impacts. The insurance costs from the Black Summer bushfires in 2019-20 for instance affected 80% of Australia’s population and caused A$2.4 billion (US$1.5 billion) of insured loss according to Moody’s. The Insurance Council of Australia says the insured losses from two extreme weather events, including deadly flooding in the New South Wales mid-coast, have already reached A$1.5 billion this year. Addressing climate change makes sense not only for a liveable planet in the future but for a vulnerable Australia.

PG: Congratulations for rejecting climate denial! How do you believe will the current government utilize its mandate to intensify the climate action it has initiated?

BP: It certainly was a win – especially when polls just weeks before the election suggested a very close race. We are fortunate that, despite the incredible power of the fossil fuel sector in Australia, the re-elected Labor government “gets” the opportunities of becoming what it likes to call “A Renewable Energy Superpower.” That means not only continuing to move to renewable energy within Australia – we are averaging an impressive 46% in our grid and occasionally reaching up to 75% renewables according to our energy regulator. It also means ramping up the development of net zero products such as green iron ore and steel, to countries that need to buy net zero in to meet their targets — China, Korea and Japan.

Albanese’s Labor government committed A$22.7 billion to a range of Future Made in Australia initiatives and incentives in 2024 – something my Climate Capital Forum advocated strongly for over three years. This included incentives for everything from Production Tax Credits and renewable energy hubs to support for green hydrogen and critical mineral mining development (full list below*). One of his party’s most important steps was announcing a home battery incentive scheme of A$2.3 billion for Australian homeowners, particularly the one-in-three that already have solar power and want to back that up with batteries. Voters sent a strong message that they back this and want more.

Our country’s real challenge, and where Labor leadership is sorely lacking, is developing a strategy to wean our export market away from coal and gas and toward the net zero products…

It’s a vast improvement on the previous Coalition (Liberals and Nations, both conservative) government, that proved itself to be irrelevant in the last election by promoting highly expensive and hugely unlikely nuclear power from a cold start — largely seen as a ruse for extending gas and coal use. It was a key reason the Coalition suffered one of its biggest election setbacks in Australian history.

Our country’s real challenge, and where Labor leadership is sorely lacking, is developing a strategy to wean our export market away from coal and gas and toward the net zero products above. Labor is still approving new gas and coal projects such as its recent approval of Woodside’s North West Shelf gas project to 2070. This and the 30 odd fossil fuel approvals Labor’s made since its 2022 election win contradict the IEA’s no new fossil fuel projects if we are to meet our global 1.5C emissions targets mandate. There is much more work to do here and we are up against all too powerful fossil fuel and mining political power keen to prevent that from happening.

The economic stakes are high. It’s time for the Labor government, with a mandate that might possibly give them six or more years in power, to pick a side and that side is net zero, not fossil fuels. Investors, businesses, importers and innovators need certainty and the government needs to provide it.

PG: Do you believe Australia is on track to become the world’s first climate superpower? Do you see efforts in place to increase renewable energy supply to 82% by 2030 and 95% by 2035; net-zero steel and iron ore; emergence as the global champion of exporting net zero?

BP: It’s a real possibility BUT that export transition challenge is a big challenge along with our lacking a startup, innovation culture that would allow us to move fast enough to take a seat in the growing net zero global market. My network, the Climate Capital Forum, and associations like the Investors Group on Climate Change are working to encourage the Australian government to learn from initiatives like those in California, the US’s IRA, Europe’s carbon price and renewable energy incentives and other successful climate financing approaches to put them in place fast and get moving. With Trump’s America leaving the field, there’s a huge gap Australia could fill if we are able to kick-start the innovation and use the incredible renewable energy and critical mineral resources we have – many would say, the envy of the world.

PG: How inclined are the money pipelines (banks, insurers, fund managers) to fine-tune with your climate aspirations?

BP: We really need the federal government to continue upping its financial and policy support to send a clear message to private investors here and overseas that this is where Australia is going. With the outcome of the election, we have three and a half years – maybe more – to lock in our efforts to become that Renewable Energy Superpower the government likes to talk about. Our investors, banks, funds managers and insurers are conservative by nature. They will need policy certainty and funding from the government and its programs like the Clean Energy Finance Corporation (CEFC) and Australian Renewable Energy Agency (ARENA) to help investors to see the opportunity and crowd in private funding to make this work.

PG: Given your climate vulnerabilities, how receptive are you to the Indigenous intelligence and practices?

BP: Sadly our First Nations communities have often been left behind in the effort to move to clean renewables but organisations like Original Power and its First Nations Clean Energy Network are changing that for the better. The First Nations Clean Energy Network is supporting more than 20 Aboriginal communities around the country to fund, install, own and run their own solar power systems and get off of polluting and expensive diesel. Their work really shows how it can be done well to ensure everyone benefits from the transition.

PG: How was your recent trip to Tiwi Islands and the interaction with the elders?

BP: It was such a privilege to be invited by the Elders of the Tiwi Island community of Pirlangimpi who have been trying to stop Santos’ Barossa offshore gas development just off their coastline. Sadly and unbelievably, they only found out about the development plans long after they were underway. There was no consultation. In 2022 Tiwi Elders took the offshore gas regulator to court, on the basis they had not been properly consulted and won in a landmark ruling that has had broader implications across environmental rights advocacy. In 2023, they lodged human rights grievances against Australia’s banks for their continued financing of fossil fuel extractors, and a delegation of elders recently travelled to Japan and South Korea to meet with key financial backers to argue that the community opposes the project on cultural and environmental grounds.

It’s a David and Goliath battle and an example of the centuries-old tactic of cashed-up corporates going into first nations communities, driving a wedge …

Sadly, they lost a key court case in 2024 against Santos on cultural heritage grounds. The company plans up to seven gas projects, one as close to 50 kms from the Tiwi coast, for export to Asia, and the community getting zero benefit and all of the impact. Santos exports 80% of its Australian-generated gas for profit offshore, pays extremely low income and resource taxes and can afford multi-billion-dollar US law firm, formerly a Trump firm, Quinn Emanuel. It’s a David and Goliath battle and an example of the centuries-old tactic of cashed-up corporates going into first nations communities, driving a wedge – usually by offering cash to those least impacted to support the project to get what they want. It not destroys the environment but often the first nations communities as well. Additional legal action is likely and the battle isn’t over yet. Labor’s leadership will be called into question here. For more information, see Jubilee Australia, who are working with the Tiwis to support their effort to stop Santos.

Meeting the elders of Tiwi

PG: I really appreciate your candid responses, Blair. Here is wishing you all the very best in your noteworthy endeavours.

illuminem

June 9, 2025

Clive Scott’s latest video: ‘Introducing Vanilla Riot’ – Victoria’s New Favourite Party/Event Band! https://youtu.be/u7Axc-Nz5ew?si=z-2P0lLvi5EYikXX

Full text of the interview: https://illuminem.com/illuminemvoices/in-conversation-with-clive-scott-on-flight-music-and-climate

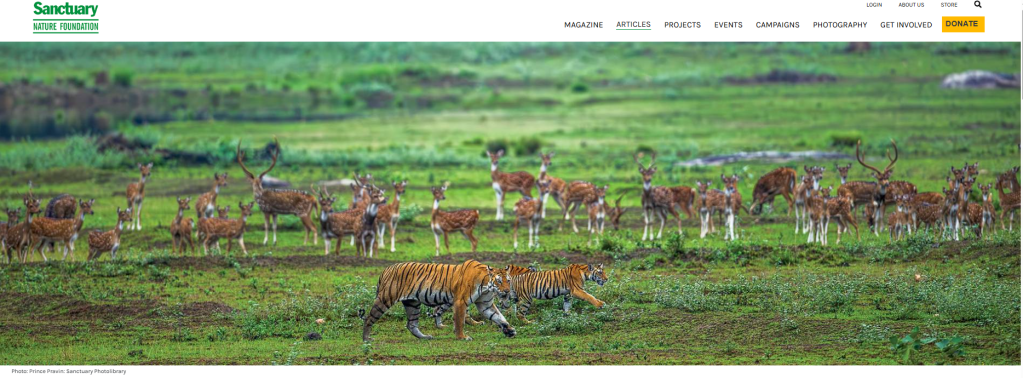

Sanctuary Nature Foundation/ LinkedIn

June – July, 2025

Article link: https://sanctuarynaturefoundation.org/article/if-they-thrive%2C-we-thrive

LinkedIn Post:

https://www.linkedin.com/feed/update/urn:li:activity:7336753162290089984/

Clive Scott is a pilot and musician who lives on Southern Vancouver Island. He has been flying for almost 45 years and a musician since first joining the school band in Grade 5. Clive grew up on a mixed farm in rural central Alberta, and spent a great deal of time in the outdoors as a young person. The influence of that upbringing, and that of his father-in-law, atmospheric scientist Dr. Geoff Strong, has led to Clive’s deep concern for the planet, particularly the critical threat of Anthropogenic Global Warming.

The progressive and compassionate attitudes of his parents, and the music of his youth, particularly the protest songs of the 60s and 70s, imbued in Clive a strong sense of social justice, and the importance of connection and empathy toward each other and our planet.

Praveen Gupta: Does composing music still excite you more than playing or singing?

Clive Scott: I still enjoy composing, but playing live to an appreciative crowd is the best. When the band gets “in the pocket” and the dance floor is full it’s a wonderful, energizing feeling.

PG: What is it about music and flying that awakens your concern for climate?

CS: Flying across Canada and watching its forests burn is a climate wake-up. Music doesn’t trigger concern, although it helps express the feeling of sorrow because of environmental disaster.

PG: How soon do you see flying transforming as environmentally friendly?

CS: There are some big challenges to making commercial aviation sustainable. Sustainable Aviation Fuel at the scale required is problematic. I think it will be some decades and need some big advances in lightweight energy tech and or fuel before aviation reaches net-zero.

“The growing awareness of the large CO2 footprint inherent in jet aviation has certainly spurred a desire to become more involved in the climate movement… Interestingly, COVID 19 has shown us that much of airline travel, while desirable, is not essential”

PG: How is your cover band and the acoustic project doing?

CS: The acoustic project is on hold for now – just not enough time. Both bands are doing well and gaining a good reputation on Vancouver Island. Latest video here: https://youtu.be/u7Axc-Nz5ew?si=z-2P0lLvi5EYikXX.

PG: Do you see any popular resistance to the extractive and fossil fuel business in the beautiful BC and Alberta provinces?

CS: Yes, particularly in the urban areas and from the Indigenous communities. A series of extreme fire seasons has people very concerned.

PG: Was your composition ‘Killers in Suits’ meant to be a commentary on capitalism?

CS: “Killers in Suits” is more a comment on greed. It addresses the darker side of capitalism, the institutionalized and untrammelled greed that always prioritizes profit and ROI over all other concerns. (The one drop rhythm is a little nod to the social justice songs of the Jamaican reggae genre’).

PG: Mark Carney’s ascendancy as the Prime Minister raises the expectations from Canadian leadership (in the global community)?

CS: So far Mr. Carney has performed reasonably well, and seems to have an understanding of the science underlying climate changes, and the risks of delaying action. If he can incorporate the values he lists in his book “Value” into Canadian economic and environmental policy he might become our best leader so far. I worry that the Liberal government (and the Conservatives too) are too embedded with the Canadian corporate establishment.

PG: Clive, may your inspiring music keep nurturing the causes deserving most attention today.

May 27 – 28, 2025

Honoured for participating in this important panel discussion. The timing could not be any better – with much of Indo-Gangetic belt experiencing mercury rising close to 50 C. Excellent effort by Aarti Khosla of ‘Climate Trends’ and the wonderful team.

The excessive heat leading to the rising Planetary fever is an outcome of growing energy imbalance. Quoting renowned environmentalist Bill McKibben: we are now witnessing 400000 Hiroshima bombs equivalent of extra heat trapped per day. Our oceans which absorb 90% of the heat – are as a result boiling. However, we are paying scant attention to the most critical climate regulator/s. Six of the nine planetary boundaries have been breached and the earth systems are under serious pressure.

Regrettably, we remain conditioned to end such discussions on a ‘positive’ note. That sounds akin to the band playing on a sinking Titanic.

In conversation with Archana Chaudhary, Vaibhav Dange and Deven Pabru

illuminem

May 13, 2025

https://www.linkedin.com/feed/update/urn:li:activity:7328629180600893440/:

In this Op-Ed for illuminem, I touch upon a #doublemateriality storm hitting Europe. All money pipelines beware!

The Norwegian Sovereign Wealth Fund – the world’s largest – having assessed 96% of its portfolio for #naturalcapital risk, now runs into this storm. Like it, this development will compel other entities to evaluate both sustainability impacts on financial performance and #societal/#environmental effects.

Norway recently awarded stakes in 53 offshore #oil and #gas exploration to 20 companies. According to its energy ministry, the next round would focus on the hyper sensitive Arctic region.

The International Energy Agency (#IEA) has opposed Norway’s plans to expand its petroleum production. Stating that “no new fossil fuel production projects are compatible with limiting global warming to 1.5C.”

The Norwegian government has also announced that 1406 #whales can be slaughtered this year – an increase from 1,157 individuals in 2024 – despite the demand for whale meat falling in the country.

“The disproportionate killing of pregnant female minke whales is particularly alarming”: says Katie Hunter. The whale hunting issues in Norway highlight the challenge of balancing economic activities with environmental care.

Double materiality demands not only portfolios are not unduly impacted by natural capital but also do not adversely impact natural capital. All eyes will now be on Norway’s sustainability paradox.