My Op-Ed in The Economic Times of September 28, 2019. Insurers must act responsibly to ensure #sustainability: https://economictimes.indiatimes.com/blogs/et-commentary/ensure-insurers-know-the-climate/

Every spring cleaning has its rewards. One of the rewards this time around – while emptying some boxes after a hiatus of almost 22 years – was this sepia piece:

A reaction to my transitioning from Bangkok to Hong Kong 26 years ago! After all the ‘jarajorn maak maak’ (too much traffic, as the Thais would say) – commuting in the then English colony was a welcome relief. Mainland Chinese city roads were still dominated by the bicycles. Flying in and out of Hong Kong meant Kai Tak airport. LukMaChow, across the border into neighbouring Guangdong province, was dominated by duck farms. Shenzhen was coming out of a slumber. Time does zip past…

Walter Murphy (WM) is a courageous man determined to follow his calling. The pull of Climate Change & ESG made him recently give up a very promising and successful career in the insurance industry. His solid insights into what will and will not work in the Climate Change agenda come from his first hand understanding of the levers of US politics. As a young man he worked at the Capitol Hill for both – the House of Representatives and the Senate. Here he unravels the wheels within wheels of the American Climate Change dynamics, as it unfolds.

PG: Jay Inslee truly set the tone for fixing the Climate Crisis but regrettably decided to stay out of the Presidential race. Thankfully, he will contest for another term as the Governor of Washington. Do you see this as a set back to the Climate Change movement?

WM: I don’t see it as a set back at all. Rather, I believe that Governor Inslee’s mere presence in this campaign pushed the climate change agenda to the forefront sooner than it eventually would have. Some would say the governor’s decision to run entirely on the platform of climate change was quixotic, but I find it fascinating and heartwarming that after his recent decision to drop out of the race, the recognition and plaudits he received from all of the remaining Democratic candidates and from many of his peers such as former Secretary of State John Kerry is a testament to the man and the convictions he has stood for all of his political life.

Governor Inslee was, I believe, the first candidate to release detailed and extensive proposals on what he felt the country needed to actively be doing to stem the ravages of climate change and to reduce this country’s carbon emissions of which the United States has been a major contributor since the early 20th century. All of the Democratic candidates have since introduced their own proposals on how they propose to tackle climate change, almost one upping each other in the process in a climate change arms race, culminating with Senator Sanders’ $16 trillion proposal to fight climate change. Governor Inslee moved the needle on this. Suffice it to say that any future candidate, regardless of whether they are Democrat, Republican or independent, running for national or statewide office will have to include a climate change plank in their platform. I believe it will become the norm and not the exception.

Governor Inslee’s moment in the 2020 presidential campaign may have been ephemeral but it was impressionable. He should be proud of his contribution.

PG: Do you see the Green New Deal as a bipartisan proposition? Does it enjoy much following in the US? Does it mean there is hope if only Democrats were to come in power?

WM: I believe any momentum in implementing any of the proposals outlined in the Green New Deal or for that matter any proposed climate change legislation will advance and succeed long term only if there is some bipartisan consensus in Congress. The American people’s regard and attitude towards the effectiveness of the United States Congress and its ability to compromise and evolve meaningful legislation is at a nadir. It will take a significant amount of work and consensus building for any proposals of the Green New Deal to achieve bipartisan support, but I am somewhat optimistic that it can be done.

First of all, the Green New Deal resolution as proposed by Rep. Alexandria Ocasio-Cortez (D-NY) and Senator Edward Markey (D-MA) is a fourteen-page resolution which calls for a “ten year national mobilization” to address climate change and economic inequality. Both Democrats and Republicans critiqued the Deal when it was announced, and it is highly unlikely that all of the proposals and initiatives laid out in the resolution has any chance of passing as a whole. However, I think that incremental changes can be made and that there could be enough support building amongst the ranks of Republicans that some of the proposals outlined in the Deal could come to fruition at some point.

Although there remain some Republicans who outright reject the existence of climate change and many who continue to deny the basic science presented to them, there are those who not only have accepted that climate change exists but that is anthropogenic in nature. These Republicans realize the future costs involved in not addressing the climate crisis and are more receptive to finding solutions now than they were ten years ago.

The other factor I believe will generate more support amongst Republicans is that the constituencies that traditionally support the GOP more and more are pushing its rank and file to further address the economic ramifications that not addressing climate change will have if left ignored. Climate change has permeated the board rooms of all the major corporations. Shareholders and customers are demanding more environmental, social and governance from the companies they do business with and whose money they entrust to invest. The financial sector recognizes the global implications that climate change is having on the bottom line and is requesting Congress to a greater extent to be more proactive in finding solutions at the federal and state levels.

There long has been an adage that Americans vote with their pocketbook. This is what I believe will drive the narrative going forward and will force both parties to act on significant legislation…

Climate change always has been a “green” issue in terms of the effects it has on our planet’s ecosystems. Ironically, the reason why we eventually will tackle this conundrum at the scale that is needed is due to another “green” issue – money and economics. There long has been an adage that Americans vote with their pocketbook. This is what I believe will drive the narrative going forward and will force both parties to act on significant legislation – whether that is increasing funding for research and development, eliminating subsidies to the fossil fuel industry or expanding electric vehicle charging infrastructure.

I also would like to present one more factor that I deem necessary in order for any Green New Deal climate change legislation to advance on a bipartisan level. Since Americans do have this cynical and mistrusting attitude toward their federal government, I think it is imperative how our legislators present any climate change legislation to the public realm. How legislators spin the climate change debate is as important as what ultimately ends up in any bill that addresses climate change.

The word “spin” is used a lot in Washington mostly with negative connotation. But I think climate change needs to be put forth as an opportunity to make positive change in our world. So much of the narrative when it comes to climate change is so pessimistic, so doom and gloom and rightfully so. Negative sells in the media and climate change is no different. By accentuating the positives that can be gained by fighting climate change, I believe the more the American people will be receptive to the ideas and proposals put forth by any legislator regardless if they are Democrat or Republican. There is a burgeoning offshore wind industry on the precipice of taking off in this country.

By spinning the benefits of what this industry would bring in terms of economics (the other “green”) – thousands of long term, sustainable new jobs, lower electricity rates, cleaner air which leads to lower healthcare rates – I think Americans would get behind legislation faster than telling them how much carbon dioxide emissions are bad for you and that this MUST be done to meet the standards set in an international treaty many know nothing about. Keeping climate change tonally positive will resonate more and hopefully persuade the American people to push its legislators to work together in the spirit of bipartisanship to enact meaningful climate change legislation.

PG: California has been historically well ahead of all states when it comes to environment. What is it that California is doing to make insurance less dysfunctional if not fully functional while actively promoting sustainability? Does the California Insurance Commissioner have an action plan in sync with the state policies?

WM: There’s a saying that “everything is bigger in Texas”. While that still may hold true, it may one day be amended to say, “everything is bigger in Texas – until you move to California”.

The economy of California is the largest in the United States, boasting a $3.018 trillion gross state product as of 2018. As a sovereign nation (2018), California would rank as the world’s fifth largest economy, ahead of the United Kingdom but behind Germany. The state is almost 164,000 square miles with diverse physical topography such as its 840 miles of coastline, to the snowcapped Sierra Nevada Mountains running through her central spine, to the economic bounty of its Imperial Valley and all the way down to the semi-arid steppe climate of southern California. As of 2018, 39.56 million people called the Golden State their home, making it the most populous state in the union and the state with the most electoral votes (55) in the electoral college. All of this makes California the “Big Enchilada”.

Because of California’s sheer size and diversity, California insurers have diverse underwriting vulnerabilities to climate change.

While summer wildfires have dominated the attention, the state also has had to deal with severe drought. One-third of California’s water supply comes from the melting snowpack of the Sierra Nevada Mountains. Meteorologists and hydrologists already are seeing fluctuating weather patterns that will adversely affect the snow levels in the future. Long term drought also has affected the state’s aquifers due to over pumping for agricultural purposes.

California Insurance Commissioner Ricardo Lara has teamed up with the United Nations to develop “sustainable insurance” guidelines that would help address climate-change-related disasters such as coastal flooding and larger wildfires – the first such partnership of its kind between the international organization and a U.S. state.

“We have a historic opportunity to utilize insurance markets to protect Californians from the threat of climate change, including rising sea levels, extreme heat and wildfires,” Lara said in a statement. “Working with the United Nations, we can keep California at the forefront of reducing risks while promoting sustainable investments.”

Commissioner Lara recently has appointed the nation’s first Deputy Insurance Commissioner of Climate and Sustainability in the United States. The Department’s new Climate and Sustainability Office will address the threat of climate change by working with the insurance industry, climate experts, California and international leaders. Commissioner Lara also is currently the vice-chair of the NAIC’s Climate Change and Global Warming Working Group. This Working Group reviews climate change risk to insurance companies, receives information regarding the use of modeling by carriers and their reinsurers concerning climate change and its impact on insurers through presentations by various experts and interested parties. The Working Group also investigates sustainability issues and solutions related to the insurance industry, and reviews innovative solutions, including new insurance products.

For more information on what the California Department of Insurance is doing to manage the risks associated with climate change, check out this comprehensive report as provided by the Department.

PG: Likewise, are you seeing any positive action flowing into the insurance policies at the Washington state thanks to the urgency and gravity of Mr. Inslee’s vision for addressing Climate Crisis?

WM: Washington Insurance Commissioner Michael Kreidler definitely has been a leader when it comes to addressing the threat of climate change to the insurance industry and the consumers that he is trying to protect. The commissioner chairs the National Association of Insurance Commissioners’ (NAIC) Climate Risk and Resilience Working Group (www.naic.org). The group’s goals include:

- Engaging with industry and stakeholders in the U.S. and abroad on climate related risk and resiliency issues;

- Investigate and recommend measures to reduce risks of climate change related to catastrophic events; and

- Identify insurance and other financial mechanisms to protect infrastructure and reduce exposure to the public.

Governor Inslee, Commissioner Kreidler and Washington Commissioner of Public Lands Hilary Franz recently authored an op-ed in The Seattle Times extolling the threats that climate change poses to the state’s communities. This kind of synergy is welcomed and needed in the uphill battle we face against climate change. Changing weather patterns and drier summers in California and the Pacific Northwest will continue to result in more prevalent and intense wildfires. As wildfires get worse, Insurers are quietly reducing their exposure to fire-prone regions across the Western United States, putting new pressure on homeowners and raising concerns that climate change could eventually make insurance unaffordable in some areas.

PG: What in your view ought to be the fundamental shift in the way insurance products and processes are designed so as to facilitate the decarbonization process?

WM: The insurance industry as a whole needs to do a better job coordinating with stakeholders such as regulators, governments and insurance standard setting organizations as how best to broaden their initiatives in mitigating the effects of climate change and increasing their investment in climate change infrastructure. According to Lloyd’s of London, damages from weather-related losses around the world have increased from an annual average of $50 billion in the 1980s to close to $200 billion in the past 10 years. At this rate, the economic costs to the industry will severely hamper its ability to invest in assets as would have in the past. Pro-action rather than reaction on the part of the industry is imperative for its future survival.

The insurance industry should continue to institutionalize climate change as a core business issue, expand its contributions towards building financial resilience to climate risks and supporting the transition to a low-carbon economy by collaborating with governments and other key stakeholders. Governments and the insurance industry should explore ways to support climate resilient and decarbonized critical infrastructure through the industry’s risk management, underwriting and investment functions. The industry needs to continue supporting the transition to a low-carbon economy through its underwriting business, investment strategies and active reduction of its carbon footprint.

PG: From your time at the Hill, is there any learning addressing Climate Change may have from Healthcare (Clinton/ Obama initiatives)?

WM: I think one of the key elements in passing successful climate change legislation will be who are the particular members of Congress driving the legislation and leading the efforts to include all factions in the debate. For me, the message bearer will be just as important as to what eventually is included in any legislation.

The decision to appoint First Lady Hilary Clinton as the point person on reforming Healthcare in 1994 had great ramifications and ended up being one of the biggest obstacles to passing any meaningful legislation. Even though Democrats controlled both houses of Congress, Mrs. Clinton was such a lightning rod for the opposition, even back then, that many Republicans bristled to work across the aisle to pass any tangible legislation resulting in a failed attempt to reform Healthcare and, in a sense, helped to spur on the Newt Gingrich led Republican Revolution which led to the Republican takeover of the House of Representatives and Senate in the 1994 midterm election.

Conversely, when I was working on The Hill in the late 1990’s, Congress was able to pass the Bipartisan Campaign Reform Act. The effort was spurred by the alliance of Senator John McCain (R-AZ) and Senator Russ Feingold (D-WI) – two respected members of the Senate who had a reputation and history of building coalitions. Their cachet as being more moderate members of their respective parties and their ability to compromise and work well with most members of the Senate ultimately resulted in passage of a campaign finance bill. It was not a perfect bill, but it did make significant changes to campaign finance laws.

Therefore, whoever is “driving the train” will be an integral component if any meaningful climate change legislation is going to make it through the legislative sausage grinder that is the United States Congress. If the charge is being made by someone such as Rep. Alexandria Ocasio-Cortez (D-NY) and Senator Bernie Sanders (D-VT), I really don’t see significant progress being made. Any meaningful legislation will need the leadership of moderates in both parties joining together to have any chance of producing significant climate change action.

The other issue I see is that there are many activists out there who want to see radical and sweeping climate change to battle the mounting threat of climate disruption. Senator Sanders, in fact, is calling for a “revolution” against climate change. Unfortunately, passing “revolutions” in Congress at any time in our nation’s history is not the norm, especially during this era of bitter and rancorous partisanship. Seismic change is not going to happen at the scale that we really need to happen in order to meet the threshold levels laid out in the Paris Agreement. Any gargantuan legislative proposal is going to turn members off, as they will think it impossible to navigate through both chambers of Congress.

Although many climate change activists might not be willing to accept tackling climate change via smaller increments, I believe it’s the only way to make any headway at all. Small victories will lead to more victories. Stringing together victories would build confidence and possibly snowball into larger proposals and greater attempts to make effective change.

PG: Is the average American serious about Climate Change? Does he/ she believe in the virtues of the Paris Agreement?

WM: In a recent Washington Post-ABC News Poll, 62% of Americans disapproved of the Trump administration’s handling of climate change compared to only 29% who approved. Year after year, Americans not only have become more accepting that climate change is a real threat to their existence and way of life, but the issue slowly has risen to become one of the top political issues of the 2020 presidential campaign.

As has the rest of the world, the United States increasingly is seeing more adverse weather conditions than ever before. From flooding in the Midwest, to oppressive heat waves in the Northeast, to longer and more intense hurricane seasons in the South, to epic wildfires in the West, Mother Nature has gotten American’s attention. There certainly are those who still debate and, in some cases, totally dismiss the science put forth in defense of climate change. But those numbers are diminishing year after year.

The more people are faced with a natural disaster event, the more people will call for action. Whether they believe in the virtues of the Paris Agreement is difficult to say.

The more people are faced with a natural disaster event, the more people will call for action. Whether they believe in the virtues of the Paris Agreement is difficult to say. The Paris Agreement was not legally binding, and countries are on their honor to adhere to the proposals to reduce the greenhouse gas emissions. President Trump’s decision to withdraw from the Agreement, I believe, galvanized many governors, mayors and state officials to carry on the efforts outlined in the Agreement. Most of the climate change action in the United States is being driven at this level.

I think what is more important is how Americans feel climate change is affecting them economically and their quality of life rather than whether they support the Paris Agreement. Support for renewable energy and a reduction of carbon emissions, in my opinion, only is going to increase and will continue to remain one of the top issues in the political arena for decades to come.

PG: Many thanks, Walter! May your passion and drive bring about the desired change to make our Planet truly sustainable.

Mrs Anjani Naravane’s (AN) journey as an author is truly inspiring. Starting from cookery books in Marathi – her versatile explorations continue – as she endeavours to delight readers of Marathi with the gems of her discovery in English and Gujarati literature. Now in her late eighties, she already has 35 books to her credit. These came about with familial responsibilities over the years.

PG: You have had spectacularly long writing

innings. When and how did it all begin?

AN: It happened like this: My sister-in-law (brother’s wife) used to

contribute to one Marathi magazine. Once she requested me to write there about

the dinner parties that we used to give because (a) we had a cosmopolitan group

of friends, (b) we used to have overseas guests staying with us for some days –

being members of a group called International Friendship League run by Shri

Mahendrabhai Meghani, and (c) I was fond of cooking, learning new recipes from

different countries! So I wrote about a party we had recently hosted when a

Swedish architect was staying with us. It included the menu and recipes.

The Editor and she liked the article and I was asked to write more often. This is how it all began. I started writing on various other topics too. I wrote three cookery books on different topics for three different publishers. So that is how I became a writer in Marathi! I also started translating good books (those that I liked) from English and Gujarati into Marathi.

PG: How many books in all, till date?

AN: Thirty five. These include five of my own, some from English into Marathi and the rest from Gujarati into Marathi.

PG: How have you evolved as an author? What are the most preferred themes you like to write about? Any specific likes for translations that you undertake?

AN: I like to talk to or find out about the younger generation’s problems. I wrote two books on this subject which are my own. The third one was given to me by my publisher to translate from English to Marathi, which I did. I also like to translate biographies of which I have done three.

PG: Would you like to mention what these problems tend to be and how are they any different from those faced by the earlier generations?

Each new generation seeks more independence. In India, we often see two or three generations living together… But generally in Western countries, I think when a couple decides to get married, they will look for an accommodation first!

AN: Each new generation seeks more independence. In India, we often see two or three generations living together. I read that in Japan too, this custom prevails; maybe in Germany as well. But generally in Western countries, I think when a couple decides to get married, they will look for an accommodation first! This did not happen in India atleast, when the new bride was expected to take over much of the physical work from the mother-in-law. So the problems are essentially different.

When people get old in the West, they are put in old-age homes; here they are (willy-nilly perhaps) looked after by their children, for lack of really good homes for the aged and also the concept is yet to take root.

PG: Which were the three biographies that you translated?

AN: 1. It’s Not About the Bike – My Journey Back to Life, by Lance Armstrong. Translation in Marathi, first published in March 2009, went into four editions.

2. Russi Mody, The Man Who Also Made Steel – published in June 2010.

3. Turning Points: A Journey Through Challenges, by Dr. A P J Abdul Kalam – published in Marathi in November 2012. It went into six editions.

I realised that two of these are actually speaking autobiographies.

PG: Which is the most favourite book written by you, till date?

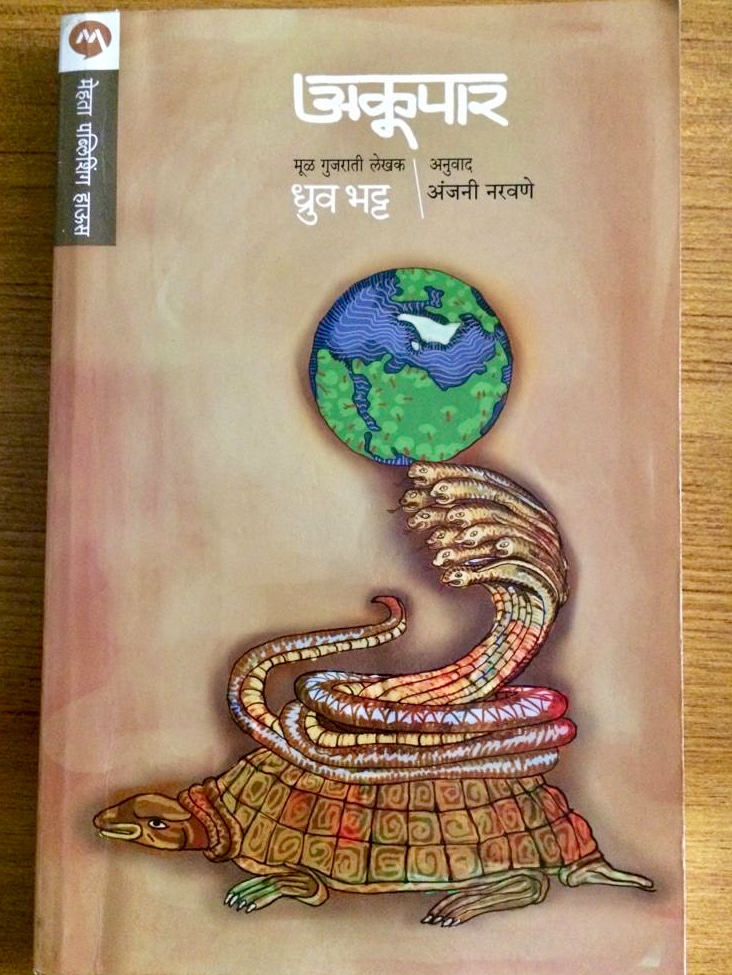

AN: I am not writing much myself these days. The most favourite book is a Gujarati novel written by the well-known Gujarati author Shri Dhruv Bhatt – Tattvamasi (literally, That Thou Art). It received the Sahitya Academy Award for the best Gujarati book that year. My Marathi translation of this book went into four editions or reprints. I translated the same in English too, on assignment by the Academy.

PG: Who do you write for – yourself or the fan following?

AN: No fan following! I translate into Marathi from English and Gujarati if I like the book and I think Marathi readers will like it.

PG: What next and when?

AN: Another novel on Mahabharat’s Bheeshma, titled Pratishruti (Remembering the Past), by Dhruv Bhatt has been translated by me into Marathi and will be out soon. Also, I have been translating good Gujarati short stories into Marathi, a collection of these should be in the market the next year or so. I think I will be calling it a day then!

PG: How in your view can more women be drawn into writing?

AN: I feel, by nature, women here are more reticent to put their ideas in writing. I had no problem because the family I married into was progressive. My Mother-in-law (born in 1894) was one of the first lady graduates in India! The situation is changing very fast and improving, giving women a wider perspective on life. The next generation is already different.

PG: Grateful thanks for the wonderful insights!

Any visit to China, wherever it is, your encounters never cease to amaze. This time the CICIRM took me to Chengdu, Sichuan. It wasn’t just the ancient past but elements of the present and the future, as well, that presented themselves in the home of Taoism, Szechwan or Szechuan cuisine, Pandas and what have you!

Dujiangyan is a pretty town on the banks of the Min River, the longest tributary of Yangtze. Its world heritage site draws immense crowds. What it is best known for is an ancient irrigation system. It was originally constructed around 256 BC by the State of Qin as an irrigation and flood control project. The water management scheme is still in use today.

Li Bing, the then governor of Shu for the State and his son – harnessed the river using a new method of channeling and dividing water rather than simply damming it. Till date it protects the Chengdu Plain from flooding.

The Panda Valley is home to Chengdu Field Research Centre. Here the Giant Pandas bred in captivity are readied to be released in the wild. An endangered past – in good safe hands of the present – ensures a secure future! The bonus comes in the form of also sighting the Red Pandas – no relatives of the black and white ones.

The Tami robot installed next to the Hotel front desk will very soon provide multiple assistance to the guests. Be these local attractions, details of the hotel or register guests for events. Customers will be able to interact with Tami using voice or touch screen commands. You no longer need to struggle with a Google translator to figure out what the hotel staff wishes to say or know! Tami is also expected to break into song and dance during coffee breaks.

Looking back just two decades, China’s current GWP – at an approximate US$ 600 bn – is 30 times of what it was when it entered the WTO. Not only has Ping An emerged as the world’s largest insurer during the short spell, in terms of revenue 8 Chinese insurers figure in the Fortune 500 list. This time frame may be like a blip in the history of world’s oldest living civilization. Yet, the last 20 years mark the most phenomenal development in the history of insurance. China edged out Japan and is slowly but steadily catching up with the USA!

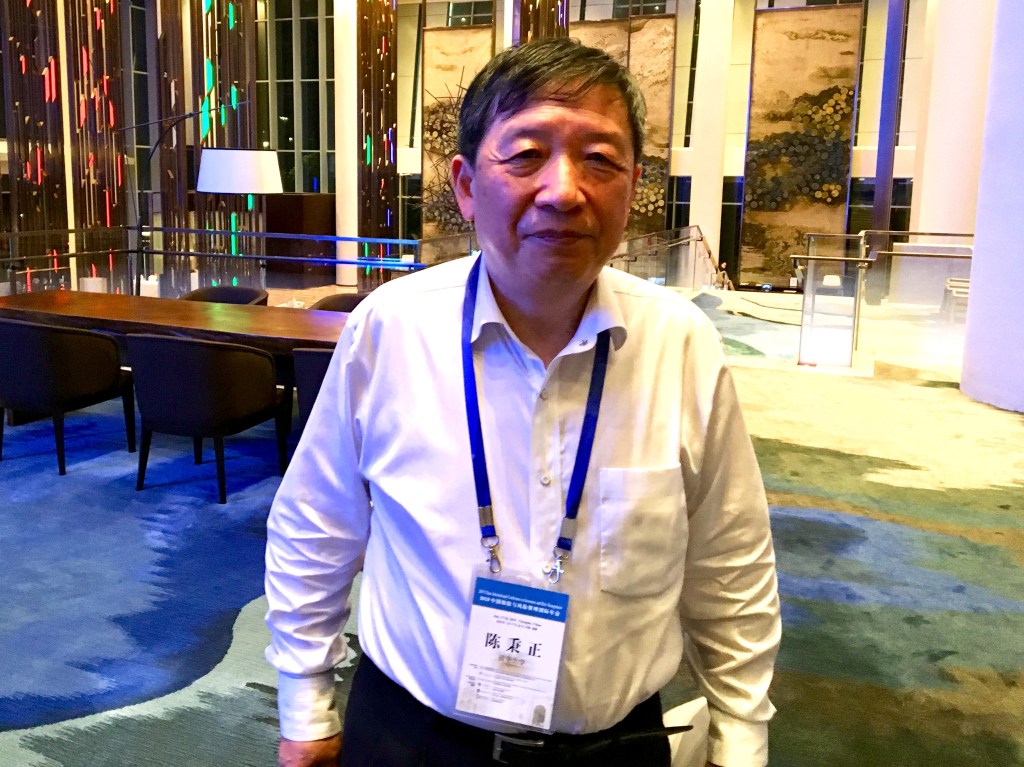

Achieving such a momentum calls for humongous effort, team work, leadership and synergies. One man who stands tall here, tirelessly working behind the scene – who I allude to as the ‘Buddha of the Chinese Insurance Market’ – is Dr. Chen Bingzheng.

Dr. Bingzheng is a Masters in Mathematics and a PhD in Operations Research and Systems Engineering. In 1984, he started as the Professor in the Department of Management Science at the Beijing-based Tsinghua University – currently ranking number 12 in the world.

Dr. Bingzheng was appointed Tsinghua’s Director of Insurance Programme – in 1999. ‘At that time China was negotiating with the World Trade Organization (WTO) the market opening including insurance. We, however, did not have enough people to man the fledgling insurance industry’.

‘There was a big and urgent need to improve our insurance education. Aegon Life gave Tsinghua a great contribution of $ 1 million to set up an insurance programme. We needed more and more people at high level. In 2008, Zurich Life set up a research centre. In a young industry, education and research also was a young area’, he recalls.

We could woo famous faculty from the US and Europe to exchange research and respective experience with the Chinese academics through this window, year on year…

‘We were very keen to set up a window for the Chinese faculty to learn about the progress in insurance education and research worldwide. We could woo famous faculty from the US and Europe to exchange research and respective experience with the Chinese academics through this window, year on year’.

This year, the China International Conference on Insurance and Risk Management (CICIRM) completed 10 years. I have had the pleasure of attending and presenting at six of the last seven. While the CICIRM is run on behest of the Tsinghua School of Economics & Management (SEM) – each year the location changes, depending upon the collaborating university. This time, it was the School of Insurance at the South Western University of Finance and Economics (SWUFE) – Chengdu, Sichuan. The elegant and sprawling green campus hosted the first day’s proceedings. Incidentally, Sichuan is renowned for its spicy cuisine, is the home for giant and red pandas and last but not the least the birthplace of Taoism.

On day one of the Plenary Sessions – for the last two years – the key focus has been on challenges relating to ageing, longevity and the looming global pension crisis. It’s a rare privilege to see top names as speakers. This time, they were all from North America. The rest was not just about say ‘ML/AI for Quantitative Risk Modelling’ – but societal grassroot level issues too – like the ‘Mechanism of Inclusive Insurance to Alleviate Poverty Vulnerability under the Impact of Agricultural Risk’ or current issues such as ‘Air Pollution and Insurance’.

Day two is sheer clockwork precision. Nine parallel sessions run ranging from three to six presentations – predominantly in Mandarin – with just a couple in English. The total count, for the day this year, was 135 papers. The day 3 ends with two plenary sessions and a panel discussion. It is truly inspiring to see papers representing multiple authors from diverse locations – not just from China but international collaborations, too. Many who showcase their work are first-time presenters in English. That I believe is the genius of Dr. Bingzheng – nudging the Chinese scholars to emerge from their cocoon and transform! In his modest words, ‘Our ambition is to develop the country better and better for ourselves and our people’.

‘The quality of papers presented has improved dramatically over the years’, says Dr. Gene Lai, James J. Harris Chair of Risk Management and Insurance, from University of North Carolina. Thanks to the CICIRM, which provides a western style platform of academic research for domestic scholars, the papers presented are more empirical now than just descriptive. The outstanding keynote speakers and the western educated Chinese scholars, mostly from the US, provide stimulating learning to the locals’. Gene himself migrated to the US from Taiwan. He has been an important member of the Conference Programme Committee.

‘In the past, students from top universities like Tsinghua and Peking would move to developed countries and few would return. More and more are coming back as academics with PhDs. There is a huge growth of opportunities in China. Many who return wish to be entrepreneurs, consultants, visiting faculties. Beijing and Shanghai are big magnets’, says Gene. In many ways CICIRM plays a part in ensuring this process. Climate Change incidentally remains high on the agenda of Dr. Bingzheng. Recently the Chinese government invited his suggestions. His scope included learning particularly from European countries Climate Change related risk management practices and the evolving laws. He believes that there is room for some product innovation, particularly in the reinsurance and agriculture space. Likewise, there is a pressing need to cover risks for renewable energy and green building.

Presented at the 2019 China International Conference on Insurance and Risk Management (CICIRM), Chengdu:

Introduction

Let us begin by being reminded that everything we insure is not benign. Insuring (and reinsuring) anything has its unintended consequences for our planet’s well-being. With the growing realisation and urgency around environmental and societal implications of insurance – insurers must quickly distance themselves from anything that adversely affects overall sustainability. This cannot be business as usual. Moreover, some enlightened insurers are moving towards Principles of Sustainable Insurance thereby attempting to create a more risk aware and resilient global society. But is it enough?

Needless to mention that these Principles launched by the UNEP Finance Initiative in 2012, serve as an additional guidance for the insurance industry to address ESG risks and opportunities. Signatories of the PSI represent 25% of the worldwide premium volume. The four principles are i) integrating ESG issues in business decisions, ii) collaborating with clients and business partners to raise awareness and to develop solutions, iii) working with governments, regulators, and other stakeholders to promote action, and iv) disclosing the progress made with regard to the implementation of the principles.

Unfortunately, the framework is non-binding and its implementation does not necessarily result in a reduction of carbon-intensive positions in the industry’s investment or underwriting portfolios. In short, while the insurance sector would be capable of a substantial contribution to sustainable development, only a small proportion of its firms have voluntarily committed to explicit goals.

“There are theoretical arguments for both positive and negative relationships between sustainability and financial performance…Moreover, most evidence indicates that sustainability considerations in business activities do not result in a significantly reduced profitability, but mitigates risk”.

For stakeholders, the cost involved in identifying truly sustainable insurers remains high. From the shareholders’ perspective, a vivid debate exists on the question whether sustainability and financial performance are a trade-off. There are theoretical arguments for both positive and negative relationships between sustainability and financial performance…Moreover, most evidence indicates that sustainability considerations in business activities do not result in a significantly reduced profitability, but mitigates risk. (Source: Are Insurance Balance Sheets Carbon Neutral? Harnessing Asset Pricing for Climate-Change Policy, by Alexander Braun, Sebastian Utz and Jiahua Xu).

The missing narrative

The recent climate strikes by school children, in many parts of the world, ought to be a wake-up call for the insurance industry as well. Insurers are known for their expertise in pricing, risk management and quantifying risk. Unfortunately, in the process, they not only end up insuring what contributes to the carbon footprint but also investing their surplus funds into such businesses. Thus ‘inadvertently’ they end up aiding and abetting climate change. We are already beginning to see two camps emerging – the American players who allegedly continue to support the fossil fuel industry (with the exception of a lone player which recently announced the shift) and the Europeans who are increasingly distancing themselves from it.

In 2016, the research firm Trucost estimated the scale of the external costs of major industries around the globe. They found that for the most polluting industries; the scale of their impact on the natural world was often as great as, if not several times greater than, the sector’s total revenue. None of these industries would be profitable if they were forced to consider external costs in their business models. The industry with the greatest impact overall was coal power generation, with an estimated impact of over a trillion US dollars across the entire world. For scale, that is the same size as Mexico’s entire economy. This data reveals the underlying issue at the heart of many of the world’s industries – that an honest accounting for their overuse of resources would almost certainly put most of them out of business. (Source: The Sustainable State by Chandran Nair).

Why must Asia be paranoid?

There are some really compelling reasons as to why Asian insurers cannot afford to ignore the call for sustainability. Not only do we have the most polluted cities in the world, we are also witnessing an alarming pace of deforestation, rising seas, eroding coastline, falling ground water levels, melting glaciers, deteriorating air quality, vehicular and industrial emissions.

The climate strike has brought back into play what renowned author and climate champion Amitav Ghosh alludes to as the ‘missing narrative’. He points out Asia is conceptually critical to every aspect of global warming: its causes, its philosophical and historical implications, and to the possibility of a global response to it. It takes only a moment’s thought for this to be obvious. Yet, strangely, the implications are rarely reckoned with – and this may be because the discourse on global warming remains largely Eurocentric.

The brute fact is that no strategy can work globally unless it works in Asia and is adopted by large number of Asians. Yet, in this matter too, the conditions that are peculiar to mainland Asia are often absent from the discussion. (Source: The Great Derangement: Climate Change and the Unthinkable by Amitav Ghosh).

While insurance remains highly under penetrated, insurers have enough information to be the go to for what is generally man made but referred to as ‘Act of God’ perils. By sheer instinct insurers are caught in their own silos and miss out on leveraging the humongous diversity they address. My favourite story is what happened at Salamieh in Syria. One of the finest cotton growing areas in the world turned into a desert primarily owing to excessive ground water consumption. The dependent unemployed population moved into urban hinterland and fuelled the brewing socio-economic unrest that triggered a civil war. If only crop or micro insurers had picked the early signals and alerted the terrorism underwriters perhaps the narrative today could have been different!

Insuring and investing in fossil fuel industry are not the only triggers for Climate Change. Insuring, for instance, say hydroelectric projects in vulnerable geographies, asset creation in earthquake and storm prone zones will also ensure the fragility of the subject matter of insurance as well as the dependent population and businesses. Amitav Ghosh could not be more candid when he compared flooding vulnerability levels of say two important Indian cities – Mumbai and Chennai – to be no different than Miami. A Fukushima kind of scenario with an atomic energy plant sitting in the precincts of Mumbai seems outside the imagination of us all. Would not the thumb rule of one percent increase in insurance penetration resulting into thirteen percent reduction in uninsured losses sound ridiculous – if only we encourage the mushrooming of poor quality assets and then end up insuring them? How much more myopic can we be?

Beware of ‘Dirty’ Reinsurance

The underwriting results – generally challenged that they are – make dependence on investment yields more compelling. In the meantime something more serious is likely to knock our doors from outside of Asia. The arrival of ‘dirty’ reinsurance! If Europe becomes a ‘no zone’ for providing reinsurance capacity to carbon intensive (fossil fuel driven) businesses – it could for want of additional capacity – potentially creep into our balance sheets.

The financials of insurers and reinsurers would thereby be further exposed to the E & S factors. Collateral damage in the form of reputation risk and shareholder activism could trigger, as well. So what must insurers do? Let’s look at the full chain. It is often forgotten that large parts of the global economy, and of the industry sectors that contribute significantly to climate change in the form of carbon emissions, are highly insured. The insurance covers many of the assets that process fossil fuels, from cars to coal-fired power plants. In other words, the insurance industry is not only linked to much of the future damage that may result from climate change, but is also connected to many of the sources of greenhouse gas emissions. (Source: Olivier Jaeggi in MIT Sloan Management Review).

This ought to be read in conjunction with the report on Insurance Working Group of UNEP’s Global Green New Deal. Going back to 2009 it endeavours ‘understanding and integrating environmental, social and governance factors in insurance’ and thereby also re-visit insurance underwriting and product development. The unprecedented financial and economic crisis that has made the financial sector, including the insurance industry, reassesses fundamental thinking and practice. Moreover, scientific wisdom over the years, along with an increasingly globalised world, has provided illumination on a myriad of interconnected ESG factors…..that can undermine the long-term health of the insurance industry, economic prosperity, the goals of sustainable development and, ultimately, life on this planet. Literally a domino effect!

The Handmaiden’s Woes

That Insurance is a handmaiden of the Industry was almost a gospel truth when I started in the trade. From an initial sense of detest to try positioning insurance into the mainstream of consciousness has been a personal exploration. With the arrival of ‘Stranded Assets’ into insurance lexicon the luxury of biding any more time seems to have passed us by. Climate Change or Crisis if I may say is the cause of the handmaiden’s woes resulting into asset stranding. It is important that we recognize how the governance of our economics and politics is converging globally into the troika of ESG? Whether or not we choose to take that seriously, we have already set a ticking time bomb.

Diminishing Carrying Capacity and resulting Stranded Assets

Let us indulge in some diagnostics ailing the handmaiden. At the heart of it all is the crying need to bring a balance between Anthropocentrism and Ecocentrism. The individual, cultural, and technological skills of humans are among the attributes that make Homo sapiens special and different. However, the true measure of evolutionary success, in contrast to temporary empowerment and intensity of resource exploitation, is related to the length of time that a species remains powerful – the sustainability of its enterprise.

There are clear signals that the intense exploitation of the environment by humans is causing widespread ecological degradation and a diminished carrying capacity to sustain people, numerous other species, and many types of natural ecosystems. If this environmental deterioration proves to truly be important, and there are many indications that it will, then the recent centuries of unparalleled success of the human species will turn out to be a short-term phenomenon, and will not represent evolutionary success. This will be a clear demonstration of the fact that humans have always, and will always, require access to a continued flow of ecological goods and services to sustain themselves and their societies. (http://science.jrank.org).

Decarbonising the Global Society: the Key Risk

Owing to its enormous size and capital base, the insurance industry should occupy a key role in the achievement of UNFCCC climate goals. If only a fraction of the sector’s USD 25 trn in investments worldwide could be directed away from carbon-intensive assets, this would constitute a substantial contribution to the efforts against global warming. It is doubtful, however, whether voluntary initiatives will be enough to genuinely implant the sustainability paradigm into the industry DNA.

We discuss two straightforward policies measures that could be pursued to reinforce the effectiveness of the CO2 test. On the one hand, regulators and investors should aim for a new set of disclosure requirements based on the carbon betas, compelling insurers to factor the climate perspective into their investment decisions. Those could be complemented by a new ESG label, either for green or even for fully sustainable insurers. On the other hand, we enrich the debate by a potential modification of the Solvency II capital requirements, based on our carbon betas. (Source: Are Insurance Balance Sheets Carbon Neutral? Harnessing Asset Pricing for Climate-Change Policy, by Alexander Braun, Sebastian Utz and Jiahua Xu).

“A new, highly complex and destabilised ‘domain of risk’ is emerging – which includes the risk of the collapse of key social and economic systems, at local and potentially even global levels,” warns the Institute for Public Policy Research.

Climate Change is not only universal; it is also cross-class. It impacts lives, health, assets and supply chains. It invokes intergenerational and trans-region justice. The melting glaciers of the Hindu Kush Himalayan region (termed the Third Pole) will impact the watersheds of the Ganges, the Brahmaputra, the Yellow River, the Irrawaddy and the Mekong – affecting multiple countries with close to a quarter of the world’s population. “A new, highly complex and destabilised ‘domain of risk’ is emerging – which includes the risk of the collapse of key social and economic systems, at local and potentially even global levels,” warns the Institute for Public Policy Research. “This new risk domain affects virtually all areas of policy and politics, and it is doubtful that societies … are adequately prepared to manage this risk.”

The Arctic is changing exactly the way scientists thought it would but faster than even the most aggressive predictions. The recent behaviour is off the charts…These trends signal trouble for people around the world. The last time the Arctic was only slightly warmer than today – about 125000 years ago – oceans were 13 to 20 feet higher. Goodbye Miami, New Orleans, the naval base in Norflok, Va., most of New York city and Silicon Valley, as well as Venice, London and Shanghai.(Source: Jennifer A. Francis in Scientific American).

A whole new approach: Mindful Underwriting, Risk Management & Investments

Until recently, most studies of environmental risk examined threats in isolation: climate scientists evaluated disruption to weather systems, biologists focused on ecosystem loss and economists calculated potential damages from storms and droughts. But a growing body of research is assessing how these factors create a tipping point in human society as well as the natural world (www.guardian.com).

Insurers need to reign in all the Diversity at their disposal to not just improve their understanding of these high velocity changes but evolve their risk management practices, offerings and pricing. So alarming are the consequences of the Climate Crisis that the wait for a physics of ironclad regulatory controls to ensure a 100% ESG compliant industry could take forever as the naysayers of Climate Crisis continue to muddy the water or the greenwashers continue to play the games. While the financial reporting standards need to be aligned with ESG, too – thereby bringing into focus the triple bottom line – the only litmus test ought to be Sustainability. The physics may wait for whatever time it takes, the chemistry need to change urgently. Insurers cannot any longer be the handmaiden of the industry – thereby quietly facilitating the stranding of assets it insures and invests in! It must get into the driving seat.

Postscript: The Theory of Sustainability

The E in the ESG is the Elephant in the form of Environment under threat – sitting pretty in the balance sheets of insurers and reinsurers. What was till recently referred to as Climate Change has metamorphosed into a Climate Crisis!

This paper is about E = SG2. S being Sustainability and G is Governance twice over. One relates to managing Underwriting the risk transfer function and the other to Investments.

References: Other than the quoted sources, following were also alluded to:

- Three Dimensions: A New World Insurance Order! By Praveen Gupta – Published by Chartered Insurance Institute – June 2019

- How Green is my Insurer? Presented by Praveen Gupta at NIA-Swiss Re Seminar – February 2019

- The Handmaiden’s Woes: Stranded Assets! Published by Praveen Gupta on www.thediversityblog.com – April 2017

Cint Kortmann (CK) is a serial entrepreneur since 1997. In 2012 he established Quant Base (http://www.quantbase.eu) to analyse Big Data. This has over the years evolved into data visualisation and interactive dashboards. In this conversation he shares insights into his business.

Cint has a Masters in Sociology from University of Groningen, Netherlands. He is a respected adviser, author and a non-executive board member.

PG: How would you precisely describe your business?

CK: We are a software company specialised in the visualisation of data through an independent, interactive dashboard. This way we facilitate data analytics, communication and transparency.

PG: Would you say at the very heart of it – is it all about dashboards?

CK: Yes, dashboards will replace spreadsheets as the human interface to get familiar with and this way understand figures and situations.

Yes, dashboards will replace spreadsheets as the human interface to… understand figures and situations.

CINT KORTMANN

PG: What makes your offerings so unique?

CK: Our product, the Smart Graph is unique as it is independent of whatever Tech company; can combine data-sets from all kind of sources; it is Web-based and can be implemented on-site, our Cloud or a Cloud chosen by the customer; It contains open-source elements; it is direct responsive and easy to handle.

PG: Who tend to be your customers? What industries do they represent? And who in there is your service user?

CK: We focus on the C-level within different companies. At the moment we provide the dashboard in the field of government, security, transport, machine building, retail, and so on. Being a product oriented company we are now looking for market oriented partners in different industries and countries to get our product sold in this huge market.

PG: Does your platform end up becoming the nucleus for communication between all stakeholders?

CK: It certainly can be the user interface and a platform people can login with a code or with open access by the choice of our customer.

PG: How can the insurance industry leverage your tools?

CK: If the Insurance Industry wants to get away from long implementation circles and wishes to handle data in an agile way, we can service them.

PG: With growing Artificial Intelligence and Machine Learning activity, what is your approach towards staying relevant?

CK: We work together with providers of AI and ML companies as a means, with human interface, to make their very high level tools accessible for the user.

PG: Thank you and best wishes!

The Udaipur airport (Maharana Pratap International Airport) is actually located 22 kilometers from the city – in a village called Dabok. Situated on the National Highway 76 which leads you further on to the legendary fortress town of Chittorgarh. The Dabok aerodrome, as it was once popularly known, had to be outside the rugged side of the Aravali (one of the oldest mountain range in the world) which houses the Lake City.

Not too long ago you would only see on this stretch occasional trucks, buses, a rare car, bullock-carts and even cyclists. It evolved into a two-way over time – while this was happening – not only did the gradient reduce but the green cover got sparser. Sightings of small wildlife came to a naught, too.

The widening roads and vanishing foliage brought the driver and driven proximate to many an interesting way-side architectural creations. Some of them now in a precarious state of existence.

As the National Highway 76 gets ready to transform into 6 lanes – many lesser known structures dating ancient and medieval period – are in all likelihood going to turn from fragile to rubble. Including something I stopped by, earlier today.

Needless to mention that the erstwhile kingdom of Mewar (Udaipur was latterly its capital) stiffly defied central rule all throughout the turbulent medieval times. Before the brutality of ‘modernity’ takes a complete toll – these relics which epitomise a rare chivalrous past and do us all proud – deserve a chance to be preserved for posterity.